Cool Info About How To Be A Market Maker

:max_bytes(150000):strip_icc()/marketmaker-56215c927e5547feb96badd6e88675e5.jpg)

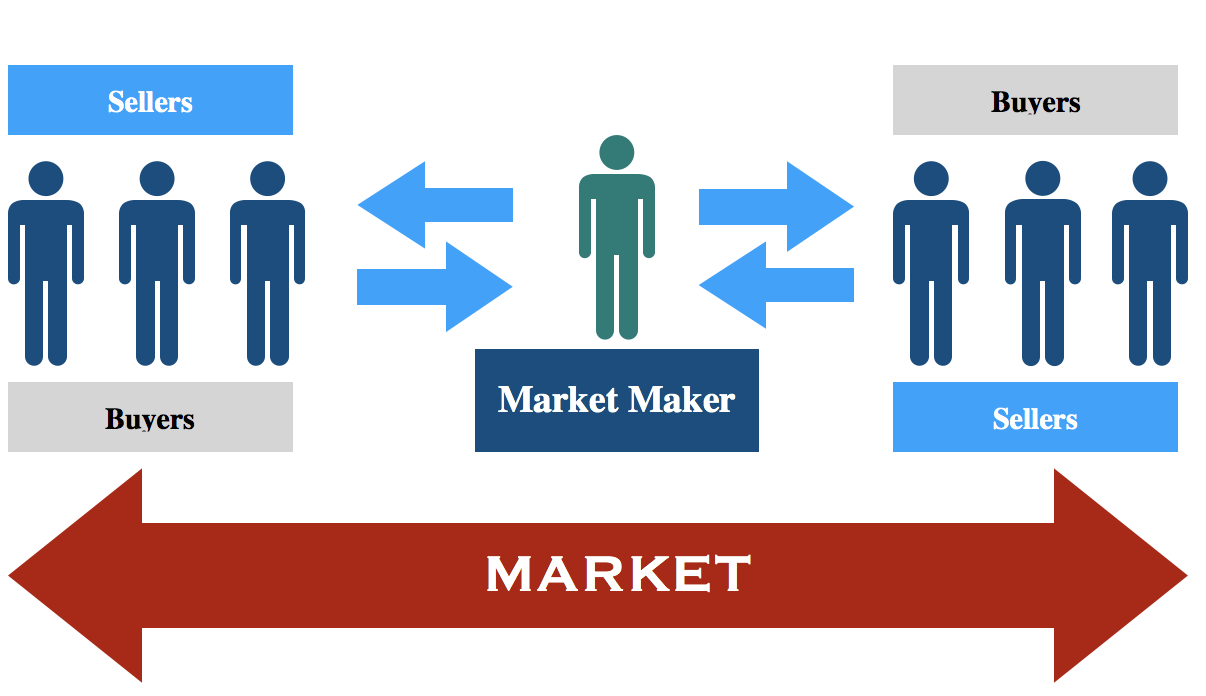

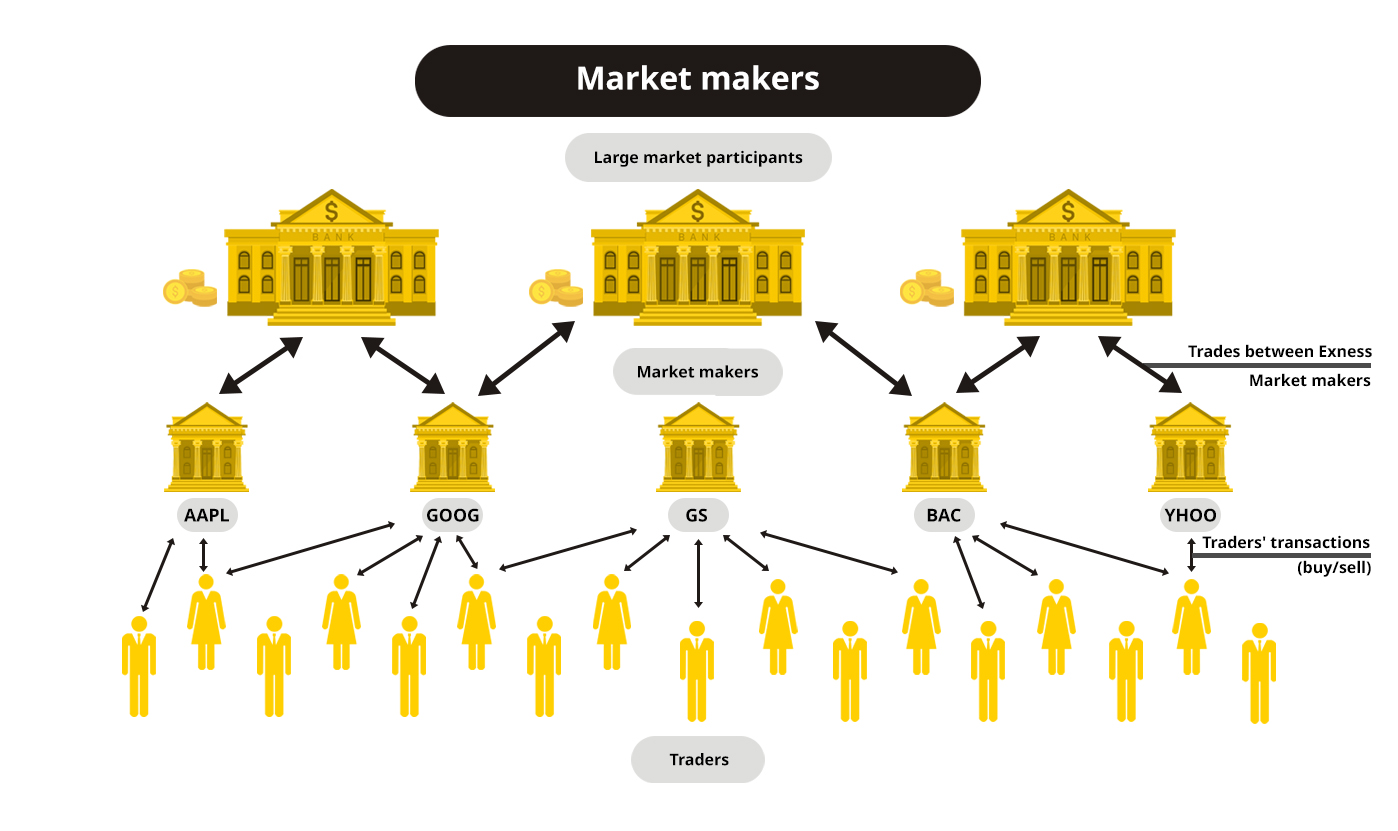

Market makers play a crucial role in maintaining liquidity and efficient trading in the securities markets.

How to be a market maker. How to become a market maker? Wsj’s asa fitch breaks down how nvidia got there—and why ai is fueling the company’s rapid. On the other hand, a market maker helps create a market for investors to buy or sell securities.

Market makers are employed to ensure sufficient liquidity and efficient trading on financial markets. Are you a market maker? At the challenger stage, you’re the new kid on the block.

Whether you want to buy a car, groceries, stocks, or bullish bears swag, you need two parties—a seller of the goods and a buyer of the goods, which in this case is you. Learn how market makers drive better outcomes for investors. Jim cramer's daily rapid fire looks at stocks in the news outside the cnbc investing club portfolio.

Over 100 million people from across the world play minecraft. As a market challenger, there are three areas you should focus on to maximize benefit: You might have seen the effects of their work — stocks moving in ways you couldn’t understand.

What is a market maker? Who they are, how they make money, & more. Market makers are a crucial player in.

Market makers provide liquidity, ensuring investors can trade in all market conditions. Nvidia added an entire netflix to its market valuation on thursday after it reported strong earnings. But what does it take to become one?

You might even turn your crafting hobby into a creative career! The purpose of a market maker in a financial market is to keep up the functionality of the market by infusing liquidity. What is a market maker?

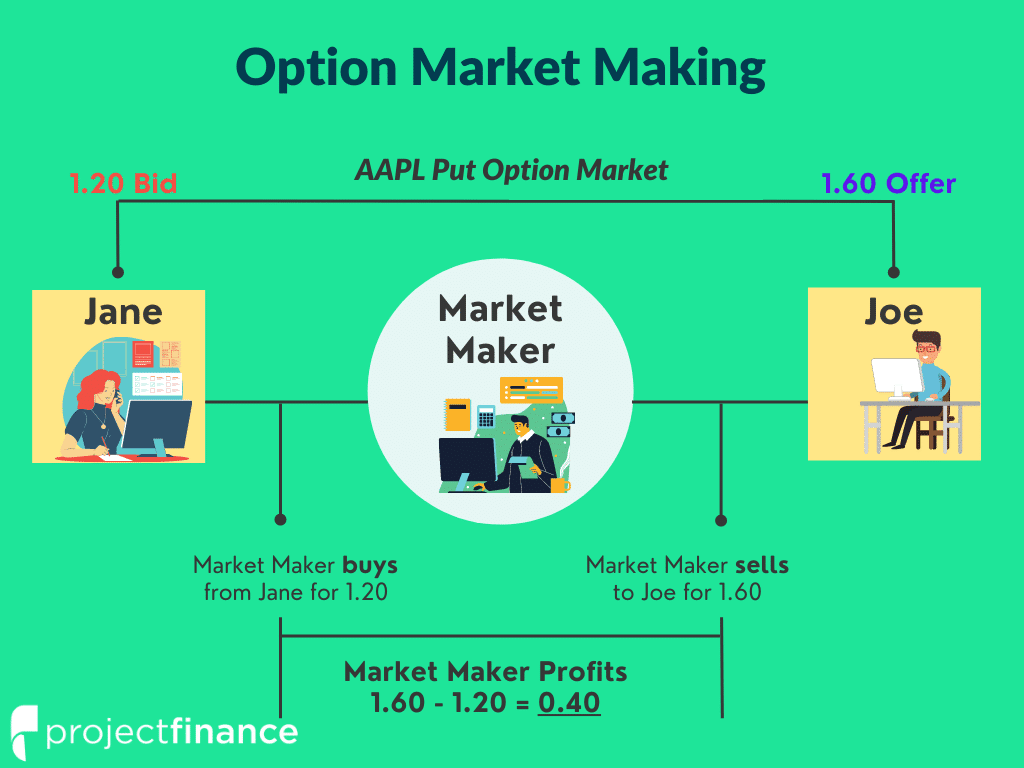

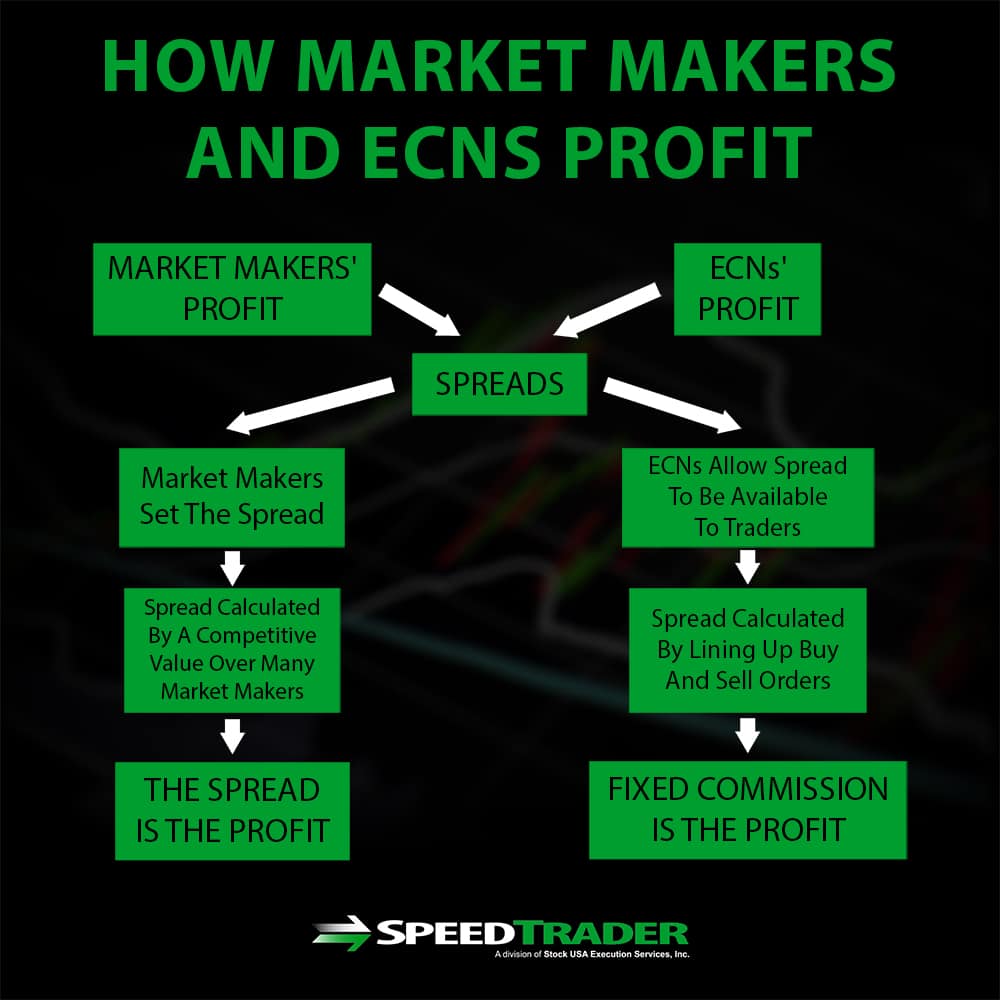

They make money by buying on the bid and selling on the ask. Market makers are liquidity providers who stand ready to buy and sell assets at any time. You’ve likely heard of them.

If you are unsure why your token requires a market maker and how to select the perfect one for your project, you’ve landed in the. Market makers must follow these guidelines at all market outlooks. Market makers commit to a guaranteed minimum fill on qualifying client orders for the securities they are assigned.

By bullish bears. How to become a market maker. How do you become a market maker?