Real Info About How To Get A Balance Transfer

How credit card balance transfers work and how to decide if getting one is the right step for you by adam barone updated january 11, 2024 reviewed by thomas j.

How to get a balance transfer. Cut back on spending 3. Once you're approved for the new card, tell that card's issuer that you want to do a transfer. Generally, you can log onto your account and request a balance transfer through the issuer's online portal.

Key points about: The minimum balance transfer limit is typically around $200 to $500. Now that you know what you owe and what your apr is, it’s time to.

You can call your issuer to request a balance transfer. Wells fargo reflect® card apply now on wells fargo's website rates & fees 5.0 welcome bonus n/a annual fee $0 intro balance transfer period 21 months from account opening on qualifying. Some common ways to request a balance transfer:

How do balance transfers work? Do your research like many things involving your personal finances, balance transfers have pros and cons worth considering. Your bank may decline a transaction due to insufficient funds.

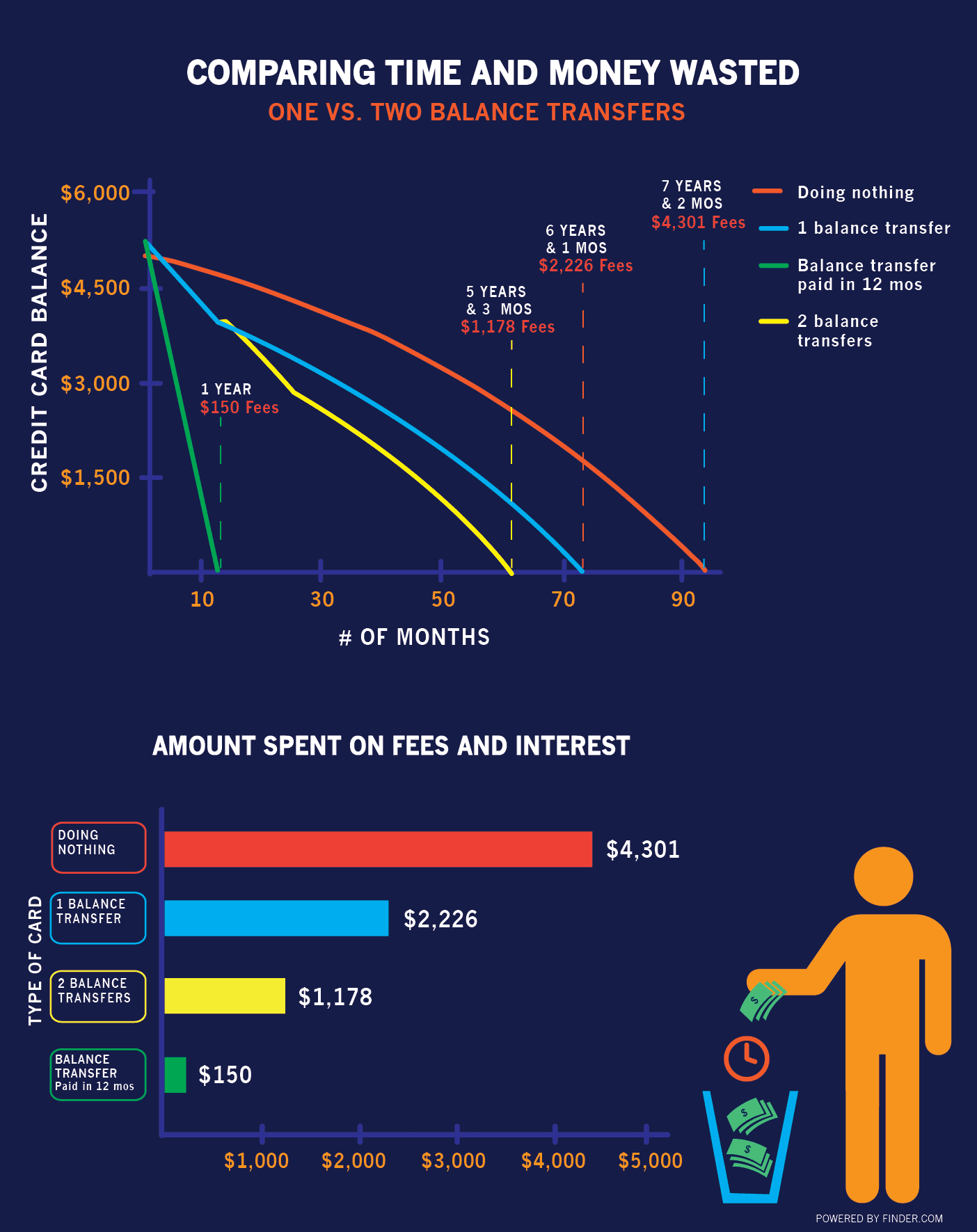

Take some time to review your credit cards that have a balance. As an example, say you have $10,000 in. Your actual savings may vary depending on the balance transfer offer you receive and the.

Before you do a balance transfer, empower yourself with information. Here are the steps to follow: To initiate a balance transfer with chase credit cards, begin by logging into your online account or contacting their customer service.

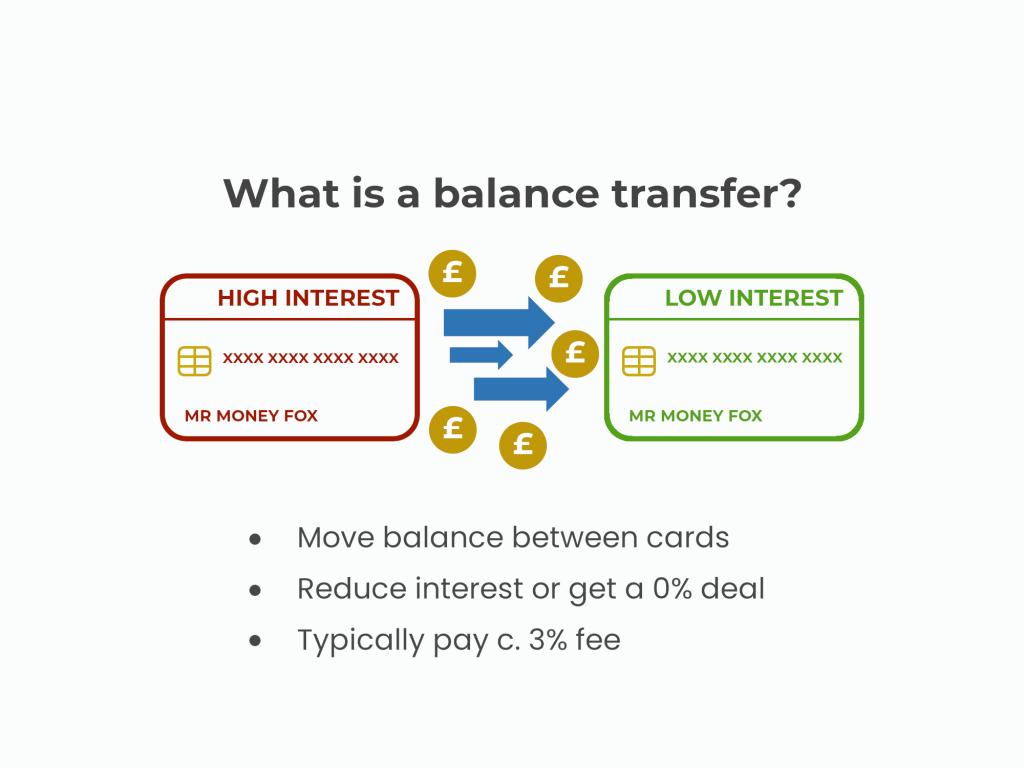

Apply for the new card. Take note of how much you. A credit card balance transfer is when you move the amount you owe (the balance) to another credit card.

The best balance transfer credit cards come with a 0% introductory apr for a period that ranges from 12 to 21 months. Choose a balance transfer card. Contact your bank to see if you.

Review your credit card balances and interest rates. Pick a balance transfer card that fits your needs. The lower the fee, the better, but even with a fee on.

You don’t necessarily need a brand new credit card to carry out a balance transfer, as many credit cards offer this service. The new interest rate on the balance you transfer may be either 0% or a special low rate for a limited time. Balance transfer fees are typically 3% or 5% of the transferred balance, and they are added to the new card’s overall debt.

![How a Balance Transfer Works Ultimate Guide [2021] FinanceBuzz](https://images.financebuzz.com/2910x1536/filters:quality(75)/images/2019/11/10/how_a_balance_transfer_works.jpg)