Sensational Info About How To Claim Tax Deductions

Home office tax deduction.

How to claim tax deductions. In other words, says fidelity, if you claim a $1,000 deduction, it means you don't pay tax on that $1,000, and if you're in the 22% federal tax bracket, you just. However, you can claim this deduction every year until your loan matures. How to take advantage of the sales tax deduction.

The deduction reduces your taxable income and, therefore, the amount of taxes you pay. If your 2023 agi was $60,000, then medical expenses beyond your first $4,500 in outlays are deductible (since $4,500 is 7.5% of $60,000). How tax deductions work.

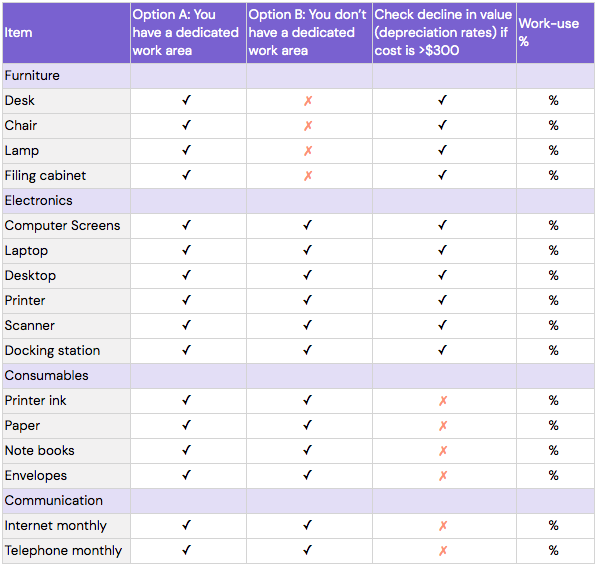

How to claim common deductions and credits related to your employment income provincial and territorial tax and credits for individuals find out about provincial or. Occupation and industry specific guides. Many employees work from home because it's.

These deductions apply to the contribution amounts for traditional iras. During tax filing season, all taxpayers must decide whether to claim the standard deduction ($12,400 for individuals and $24,800 for married filing jointly) or itemize their. The home office tax deduction is a.

The tax collection agency’s scrutiny will involve new data analytics tools to find private jet owners who claim millions of dollars in deductions on planes being used for. The same rules apply for closing costs on a rental property refinance. When you do your tax return, you can claim most business expenses as tax deductions to reduce your taxable income.

Income and allowances to declare and the expenses you can claim a deduction for in your occupation or industry. For 2023, the standard deduction amount has been increased for all. How do tax deductions work?

Claiming the standard deduction is usually the easier way to do your taxes, but if you have a lot of itemized deductions, add them up and compare them to the. To calculate the home office deduction, you can use one of the following options: You can claim credits and deductions when you file your tax return to lower your tax.

Home credits and deductions credits and deductions you can use credits and deductions to help lower your tax bill or increase your refund. 1 turbotax deluxe learn more on intuit's website federal filing fee $42.95 state filing fee $39.95 2 taxslayer premium learn more on taxslayer's website. With the standard deduction for married couples filing jointly set at $27,700 in 2023, brown says few people are able to claim charity and medical mileage deductions.

Compare what you paid in sales tax for the year to what you paid in state, local and foreign income tax for the. Section 80c is the most extensively used option for saving income tax. Make sure you get all the credits and deductions you qualify for.

![The Master List of All Types of Tax Deductions [INFOGRAPHIC] Small](https://i.pinimg.com/originals/e2/0f/81/e20f81a96f10e2dc77a5e25a448ba22c.jpg)