Fine Beautiful Info About How To Sell Short

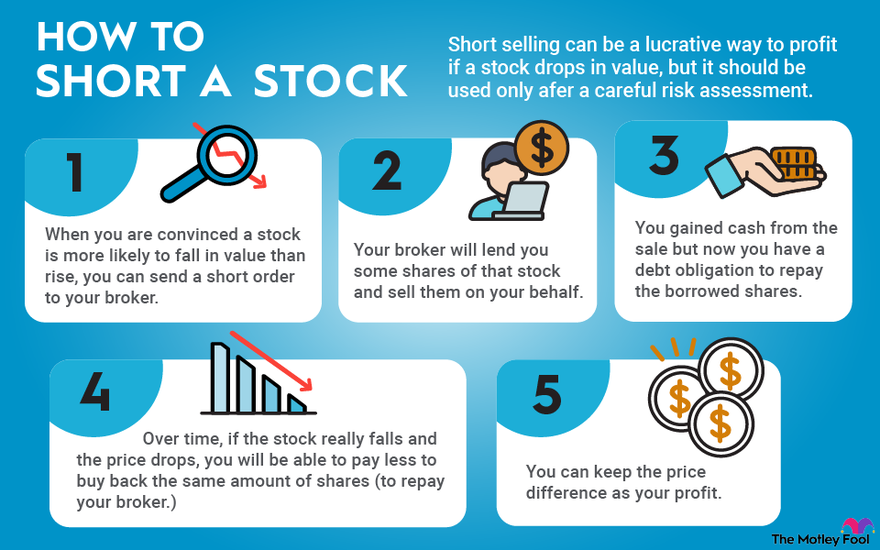

Identify the stock that you want to sell short.

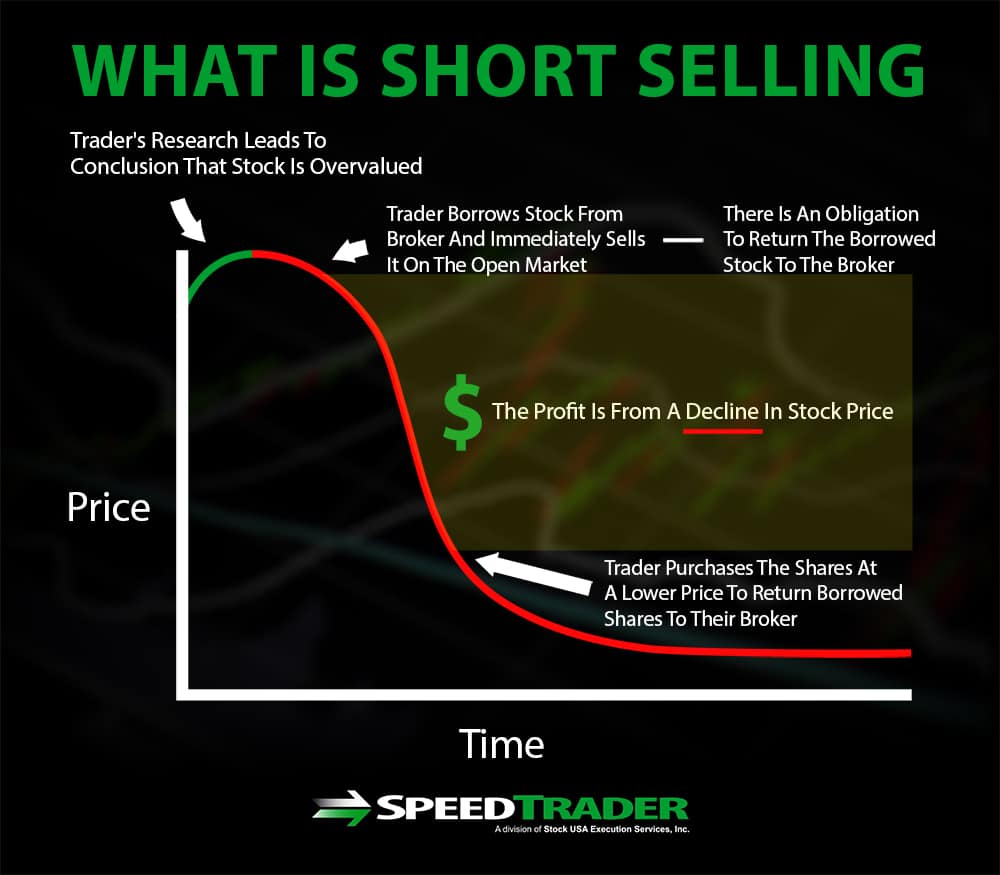

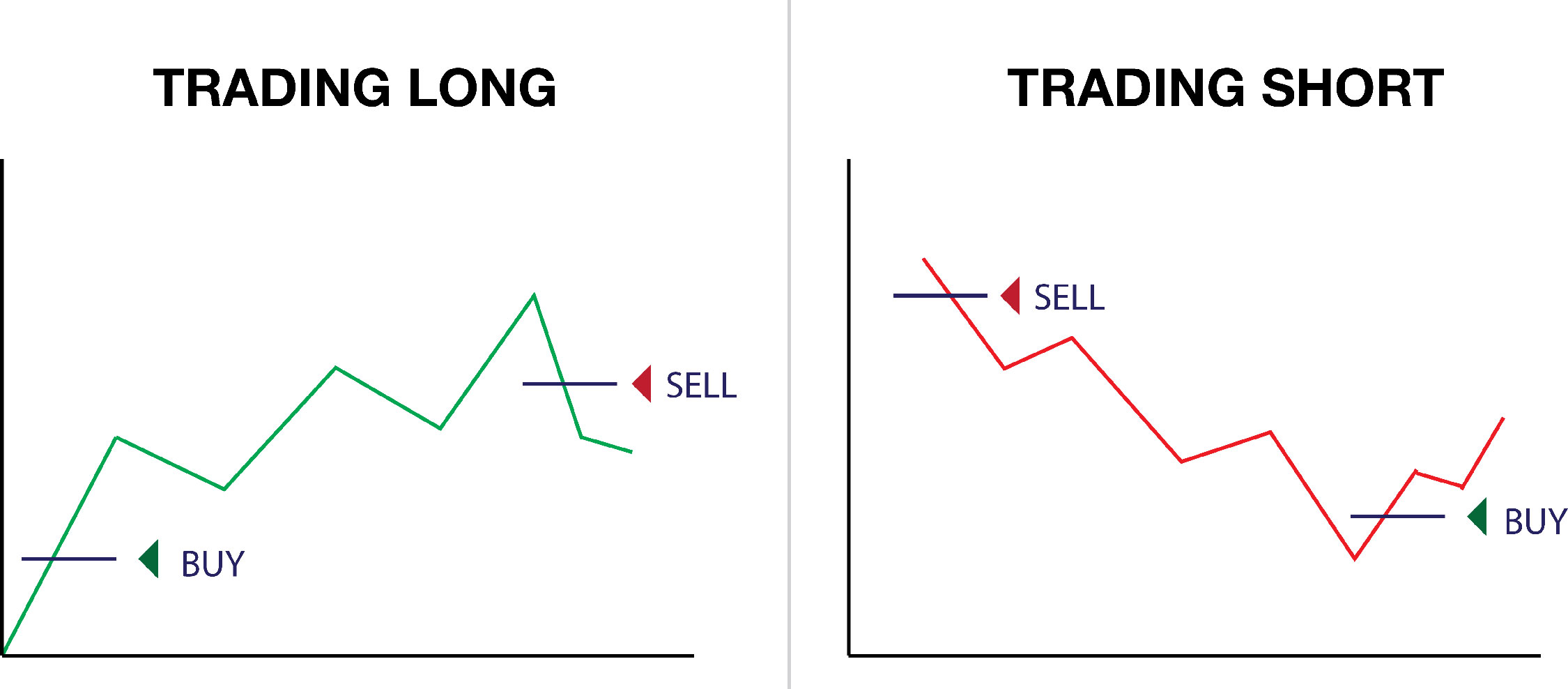

How to sell short. The other benefit of short selling in stocks is that the profits correlate negatively with most long side trading strategies. Shares on thursday has left short sellers with about $3 billion in paper losses, according to an analysis by s3 partners llc, which called it an “ai generated. Short selling is a strategy for making money on stocks falling in price, also called “going short” or “shorting.” this is an advanced strategy only experienced investors and traders should try.

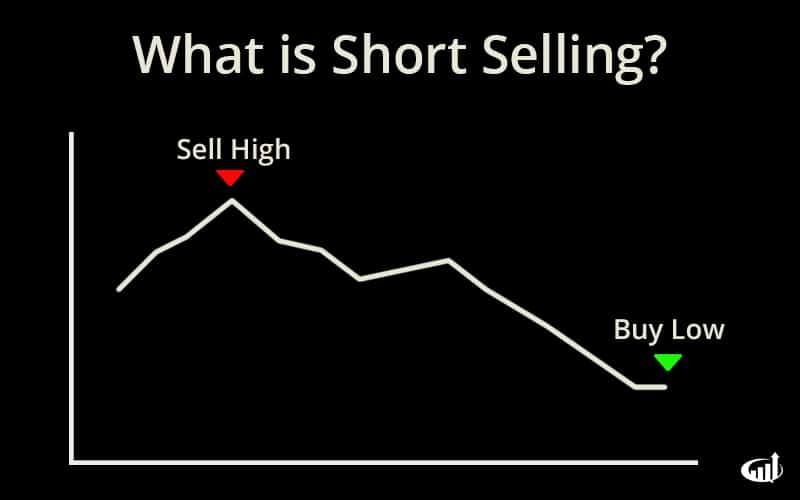

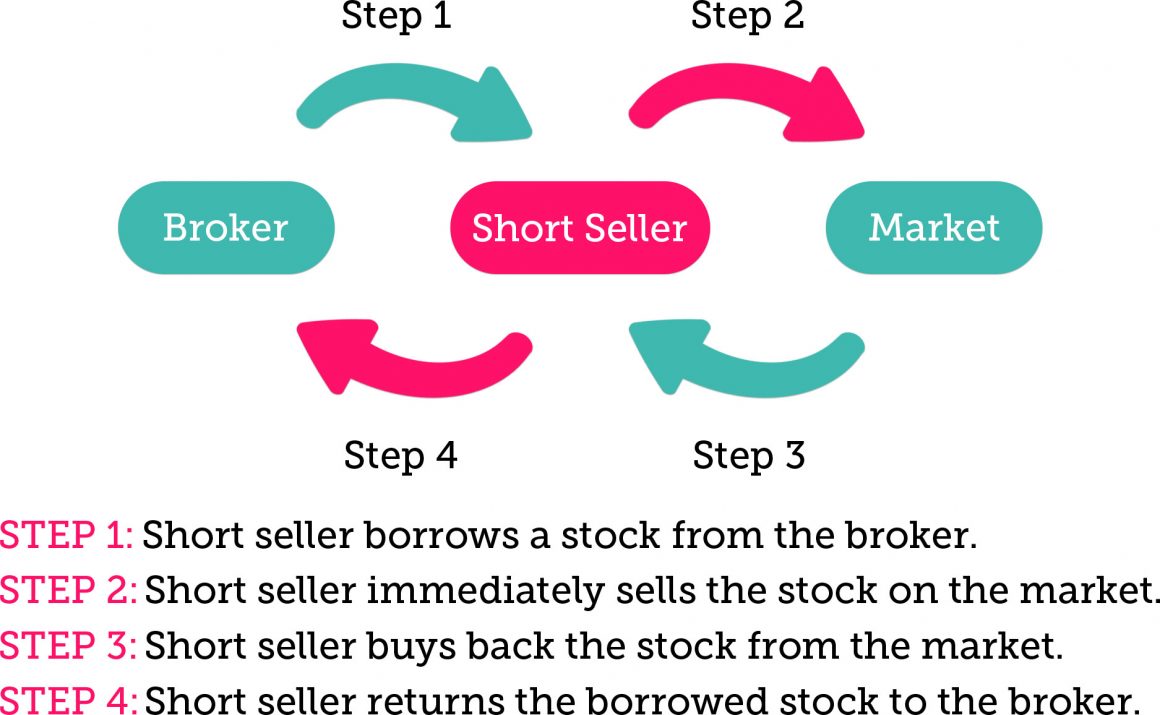

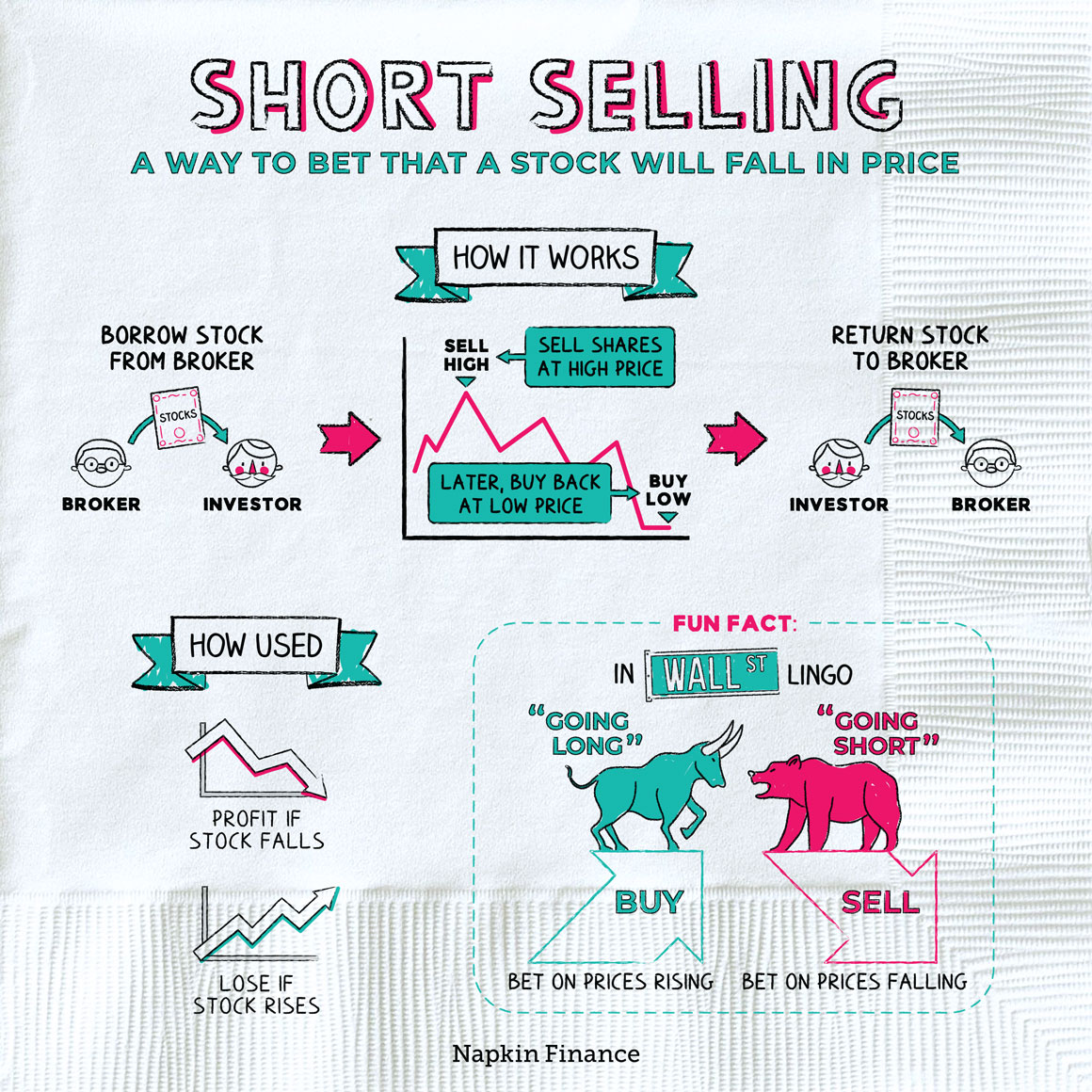

You’ll need to do research to find a stock that you think is poised to decline. When you short a stock, you sell stock that you borrowed from your broker at a set price. Decide whether you want to invest in shares or speculate on their price movements via derivatives.

Shorting is the process of selling stock short. Reddit, the san francisco social media site that describes. Make your first deposit 3.

For example, short selling was highly profitable during the bear market of 2008 and the covid crash of 2020. You’ll have the option to short sell any market by clicking ‘sell. Here are the steps to short a stock:

Short selling comes with numerous risks: Short selling is an investment or trading strategy speculating on a stock's decline or other security’s price. How to sell short on e*trade?

How to short a stock. The strategy is primarily used for both speculation and hedging. To close out the trade, the.

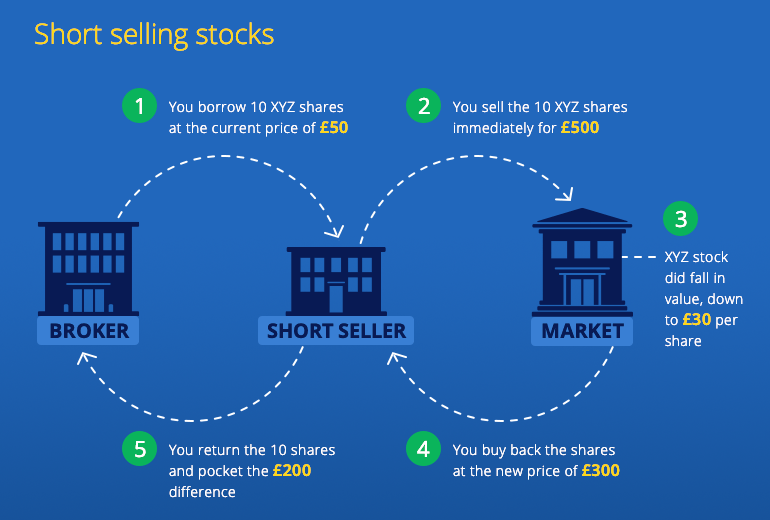

Find the stock you want to short: Short selling refers to borrowing shares and then selling them at a higher price with the objective of purchasing them later at lower prices, thereby making profits out of this difference. A guide for beginners by jervis gonzales sep 20, 2023 short selling is a popular investment strategy that allows traders to profit from price declines in various securities.

Monitor the market price to see if your prediction was correct. Short selling, also known as ‘selling short,’ is a financial strategy employed by investors to profit from the decline in the price of a security. Note that you have to declare.

Developing a short selling strategy could be a good alternative for investors, although there. Make sure that you have a margin account with your. To short a stock, a trader initiates a position by first borrowing shares from a broker before immediately selling that position in the market to other buyers.

Enter a regular sell order to initiate the short position, and your broker will locate the shares to borrow automatically. Borrowing shares from the brokerage is effectively a margin loan, and you’ll pay interest on the outstanding debt. On fidelity investments, short selling involves selling borrowed securities in the hope of buying them back at a lower price, thereby generating a profit.